Duty Free Malaga Airport

Duty Free Malaga Airport

Our guide to Duty Free Malaga Airport provides detailed insights into guidelines and tax-free allowances, ensuring your purchases are both enjoyable and customs-compliant.

Is Malaga Duty Free Shopping Cheap?

We know that sometimes buying at Duty Free is our the option to pick up last-minute gifts, alcohol, etc. However, in our experience, it is more expensive than shopping in Spain. For example, the other day we purchased two bottles of gin in Malaga Duty Free and it came to 60€. In the shops along the Costa del Sol, however, it would have cost us around 40€-45€. On the other hand, boxes of cigarettes are about the same as you would buy in the shops. They work out around 5€ a packet at the moment. But if there is a specific brand you like, it’s best to buy them at a Spanish tobacconist.

AENA Duty-Free Guide

All the information you need about Duty-Free allowances at Malaga Airport: you can find all the Malaga Airport Shopping here. When travelling from the EU to the UK, you do not have to pay any tax or duty on goods you have brought in from another EU country as long as:

- Tax was included in the price when you purchased the items

- The items are for your own use

- The items have been transported to the UK by you

- Items include gifts but are not intended to be used as payment or resold

The EU Countries are Austria, Belgium, Bulgaria, Croatia, Republic of Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain (but not the Canary Islands) and Sweden.

- If you are going to be bringing back Duty Free to the UK, we highly recommend you check all information directly here: Duty Free from EU Countries.

DUTY FREE – Arriving in the UK

Bringing goods into the UK for personal use. If you’re travelling to Great Britain (England, Wales or Scotland) from outside the UK, your personal allowances mean you can bring in a certain amount of goods without paying tax or duty. Continue to read more about allowances here on the GOV.UK website.

Duty Free / Tax Allowance Within the EU

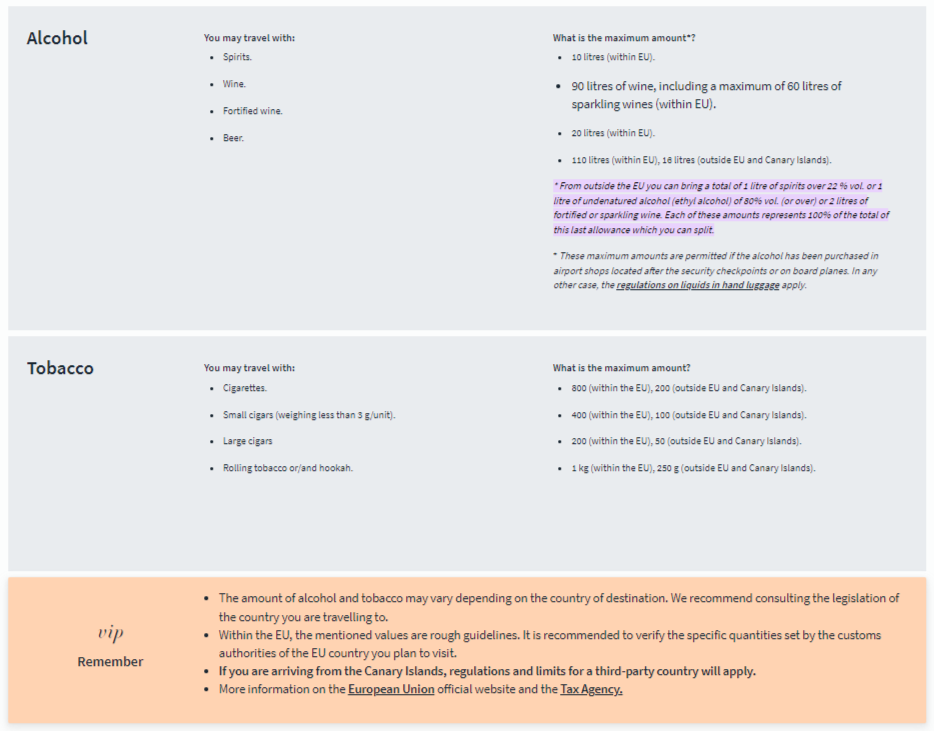

Whilst there are no limits to the alcohol and tobacco you can bring in from EU countries, should you exceed these amounts, you could be questioned by a Customs Officer.

From outside the EU, you’re allowed to bring up to 1 litre of spirits over 22 % OR 1 litre of undenatured alcohol (ethyl alcohol) of 80% (or over) OR 2 litres of fortified or sparkling wine. Each of these amounts represents 100% of the total of this last allowance which you can split.

| ITEM | AMOUNT ALLOWED |

| Cigarettes | 800 (within the EU), 200 (outside EU and Canary Islands) |

| Cigarillos (small cigars) | 400 (within the EU), 100 (outside EU and Canary Islands) |

| Cigars | 200 (within the EU), 50 (outside EU and Canary Islands) |

| Smoking Tobacco | 1 kg (within the EU), 250 g (outside EU and Canary Islands) |

| Beer | 110 litres (within EU), 16 litres (outside EU and Canary Islands) |

| Spirits | 10 litres (within EU) |

| Wine | 90 litres of wine, including a maximum of 60 litres of sparkling wines (within EU) |

| Fortified Wine (ie: port or sherry) | 20 litres (within EU) |

| Perfume | 60cc/ml |

| Eau de toilette | 250cc/ml |

| Value of goods, gifts and souvenirs | €300 if entering EU country by land or sea and €430 for air passengers |

| Cash | If you plan to enter or leave the EU with EUR 10.000 euros or more in cash (or the equivalent in other currencies) you must declare it to the customs authorities. |

All of these maximum amounts detailed in the table above are only permitted if the alcohol has been purchased in airport shops located after the security checkpoints or on board planes, in other words, in Duty Free. In any other case, the normal regulations on liquids in hand luggage in Spain will apply.

Duty Free / Tax Allowance from Non-EU Countries

- The UK is no longer in the UK, and for custom purposes, the Canary Islands, North of Cyprus, Gibraltar and the Channel Islands are not part of the EU.

- For the UK, we advise you to check here all details for Duty-Free from Non EU Countries.

| ITEM | AMOUNT ALLOWED |

| Cigarettes | 200 |

| Cigarillos (small cigars) | 100 |

| Cigars | 50 |

| Smoking Tobacco | 250g |

| Spirits | 1 litre |

| Wine | 2 litres |

| Fortified Wine (ie: port or sherry) | 2 litres |

| Perfume | 60cc/ml |

| Eau de toilette | 250cc/ml |

| Value of goods, gifts and souvenirs | €300 if entering EU country by land or sea and €430 for air passengers |

| Cash | If you plan to enter or leave the EU with EUR 10.000 euros or more in cash (or the equivalent in other currencies) you must declare it to the customs authorities. |

More questions about Duty Free Malaga Airport?

If you have more questions about Duty Free Malaga Airport, why not join our Facebook Group The Costa Del Sol Travel Forum? We have a community of thousands of members who travel to Malaga frequently and they’re always happy to help. Also, follow us on our Facebook page for the latest updates.